Lenka Kočerová | 18.6.2024

Interest on tax deductionTaxes, accounting, law and more. All the key news for your business.

In the following article, we would like to acquaint you with the development that has occurred since the beginning of this year in the area of double taxation conventions between the Czech Republic and other countries.

Double taxation convention with Bangladesh

On 15 January 2021, a new convention between the Czech Republic and Bangladesh on prevention of double taxation in the area of income taxes and prevention of tax evasion and tax avoidance came into operation. It was signed in Prague on 11 December 2019.

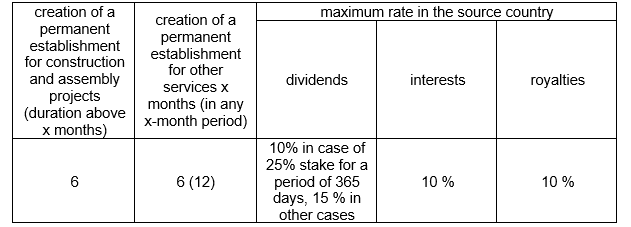

With its content, the convention basically corresponds to the OECD Model Tax Convention. Compared to the model convention, it explicitly designates a farm, plantation or another place, where farming, forestry or similar activities are performed, as a permanent establishment. Article 12 of this convention, in addition to royalties, also applies to fees for technical services, which, for the purposes of the convention, are understood to mean payment for any services of technical, or consulting nature. Other important parameters of a contract from the perspective of creation of a permanent establishment and taxation of income from dividends and royalties are listed in the following summary:

In the Czech Republic, the new rules under this convention will first be applied to income paid for or credited as of 1 January 2022, if these are taxes withheld at source, or to income for every tax year beginning from 1 January 2022 or later in case of other income taxes.

Double taxation convention with San Marino

On 27 January 2021, a new convention was signed in Rome between the Czech Republic and the Republic of San Marino on prevention of double taxation in the area of income taxes and prevention of tax evasion and tax avoidance. This convention will come into operation, after the legislative process has been completed in both contracting countries.

Amendments of existing conventions

The process of amending existing double taxation conventions currently continues, following the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI). The amendments mainly relate to wording of the preamble of the individual conventions, articles that treat amicable solution of cases, as well as articles granting a right to decline advantages based on these conventions in case of their obvious misuse. In this year, currently existing conventions with Pakistan, Chile, Portugal, Russia, Egypt, Switzerland and Greece have been amended in this way.